Receive free US interest rate updates

we will send you myFT Daily Digest Email summary of latest information US interest rates There is news every morning.

A Financial Times survey of most leading academic economists showed the Fed would defy investor expectations and raise interest rates by at least another quarter of a percentage point.

More than 40% of respondents said they expect the Fed to raise interest rates by twice or more from the current baseline level of 5.25-5.5%, a 22-year high.

That contrasts with sentiment in financial markets, where traders in federal funds futures believe the Fed’s policy settings are stringent enough to control inflation and therefore keep rates on hold until 2024.

The survey, conducted in partnership with the Kent Clark Center for Global Markets at the University of Chicago Booth School of Business, suggests that fully removing price pressures and bringing inflation back to 2% would require higher borrowing costs than market participants currently have. expected.

“Some of the signals we’re getting are that policy is not that tight,” said Julie Smith, an economics professor at Lafayette College. She noted that while interest-rate-sensitive sectors like the housing market are still “ Surprisingly strong” but suffered an early hit.

“The consumer pullback doesn’t seem to be enough to slow economic growth, and I think that’s the real problem.”

About 90% of the 40 respondents surveyed from September 13 to 15 believed the Fed had more work to do.

Nearly half of economists surveyed predicted the federal funds rate would peak at 5.5-5.75%, suggesting rates would rise another 25 basis points.

Another 35% expect the Fed to raise another two and a quarter percentage points, pushing the benchmark interest rate to 5.75-6%.

A small majority (8%) think the policy rate will exceed 6%.

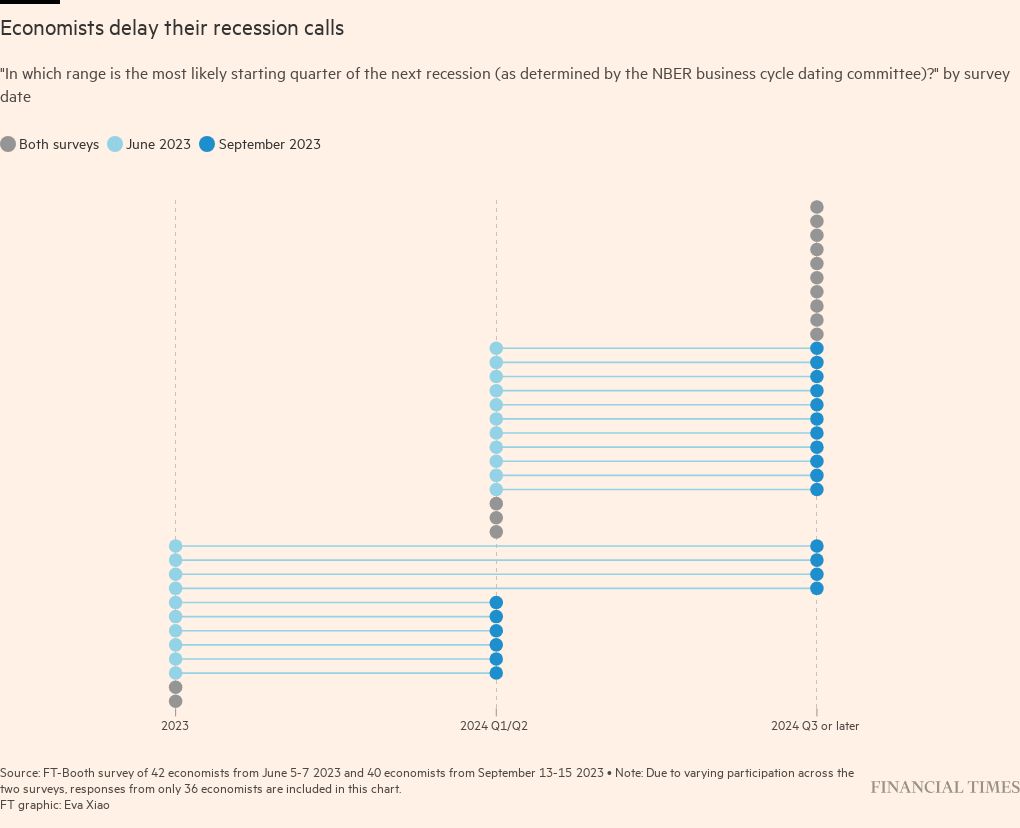

Once rates peak, economists surveyed overwhelmingly believe the Fed will keep rates at that level for quite some time. About 60% of respondents believe the first rate cut will occur in the third quarter of next year or later.

That’s nearly double the share of economists who predicted that time frame in the last poll, in June.

The survey comes just days before Fed officials are due to hold their next policy meeting, where they are expected to again delay further action.

The rapid policy tightening since March 2022 has been the most aggressive move to reduce demand in decades.

While inflationary pressures have subsided and the labor market is softening, many economists surveyed worry that underlying momentum in the world’s largest economy remains too strong and that inflation will become harder to eradicate.

“Just as there is concern that the Fed will react too slowly, you don’t want the Fed to ease too quickly,” said Gordon Hansen, a professor at Harvard Kennedy School.

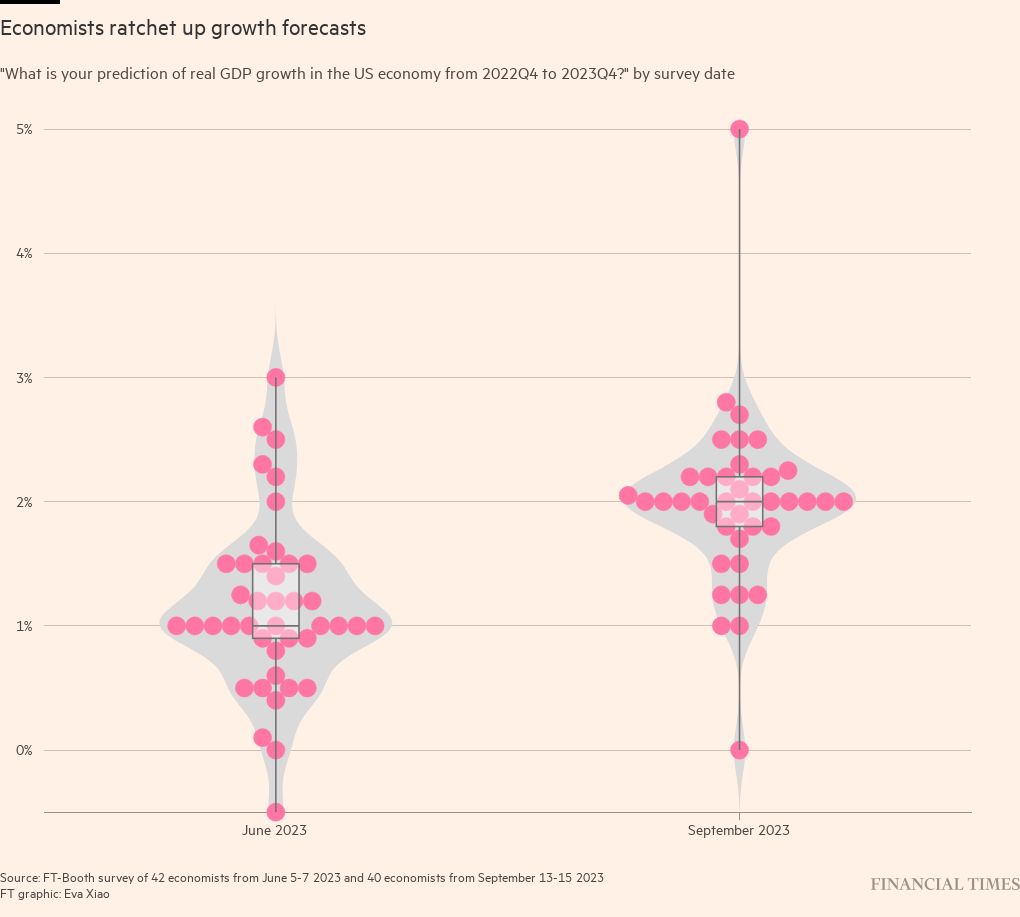

Since June, the survey’s respondents’ forecasts for year-end economic growth have doubled to a median of 2%.

The unemployment rate is expected to hold steady at 4%, while the Fed’s preferred inflation measure – the personal consumption expenditures price index excluding food and energy prices – is expected to slow to 3.8%. As of July, the latest data, the growth rate was 4.2%.

Only one-third think it is “very” or “somewhat” unlikely that core inflation will exceed 3% by the end of 2024. The vast majority thought the odds were even or better.

They said reduced oil supplies were the biggest risk to the inflation outlook.

University of Notre Dame professor Christiane Baumeister is among those worried about energy prices after Saudi Arabia and Russia decided to cut supplies. She expects further price increases, which could raise expectations for future inflation and delay the decline in core price growth if businesses choose to pass on higher costs to consumers.

A sharp slowdown in China’s economy may offset this effect; it will weigh on global economic growth in the coming months.

Domestic headwinds, including retaliation for student loan repayments and the looming threat of a government shutdown, could further weigh on demand.

Sebnem Kalemli-Özcan, an economist at the University of Maryland and a member of the New York Fed’s economic advisory panel, was among the majority of economists surveyed who believed in a so-called neutral rate – a level that neither stimulates nor inhibits economic growth. –Temporarily higher than in the past.

She said that would further delay the Fed’s rate cuts next year.

“We don’t know exactly how tall the R-star is right now, although we feel it’s higher,” she said.

Economists surveyed have become more optimistic about the possibility of a soft landing, in which the Fed can reduce inflation without causing too many job losses.

More than 40% of people believe that it is “likely” for the inflation rate to fall back to 2% with the unemployment rate not exceeding 5%. Another quarter said “possibly.”

When asked about the timing of the next recession, many pushed their forecasts back beyond their previous forecasts.

Svlook