A year ago, President Joe Biden ushered in a new era of American industrial policy by signing the Reducing Inflation Act and the Chips and Science Act into law. The two laws, passed in succession last August, provide more than $400 billion in tax credits, loans and subsidies, all aimed at boosting domestic clean technology and semiconductor supply chains.

Driven by the landmark legislation last year, the FT identified more than 110 large manufacturing announcements, including semiconductors, electric vehicles, batteries and solar and wind components. We checked them out and talked to experts, and here’s what we learned.

$224 billion in projects and 100,000 jobs

Since the passage of the IRA and the Chip Act, the US has announced at least $224 billion in clean technology and semiconductor manufacturing projects. Together they pledged to create 100,000 jobs. From August 2022 through this week, companies have announced at least $100 million, according to the Financial Times.

Although the pace of announcements has slowed, each month since the bill passed has brought new projects. This month, Singapore-based Maxeon Solar Technologies announced a $1 billion solar panel factory in Albuquerque, New Mexico, while U.S. manufacturer First Solar chose Louisiana for its fifth, $1.1 billion factory. It is the largest capital investment in the region’s history.

“(The IRA) is working to accelerate the nation’s energy transition, spur economic growth and jump-start a renaissance in American manufacturing,” Gregory Wetstone, chief executive of clean energy lobby group the American Renewable Energy Council, said in a statement. “I don’t think I’ve ever seen any law in my career have such an impact on the economic development of this country. “Monday team.

The biggest commitments come from semiconductor groups: Intel will expand its campus in Arizona, TSMC will build a second manufacturing plant in the state; IBM will invest in the Hudson Valley region of New York, and Micron will build the largest semiconductor factory in the United States in Clay, New York .

Planned project sites are spread across the country, but certain states and territories are leading the way, with new manufacturing centers emerging. Georgia and South Carolina received the most projects, with 14 and 11, respectively. Michigan and Ohio are close behind, followed by Arizona.

“It just makes you shudder and think about what the next 10 to 20 years will look like — what will the Midlands look like?” South Carolina Deputy Secretary of Commerce Ashley Tisdell said of Volkswagen’s $2 billion investment in the region. said at the time of plans to build an electric vehicle factory in the central region of the state. South Carolina offered Volkswagen a $1.3 billion incentive program to keep the project going.

Republican constituencies are already getting dollars

The FT found that more than 80% of cleantech and semiconductor investments announced in the past year have gone to Republican constituencies, despite no congressional Republicans voting for the IRA and only lukewarm support for the Chip Act .

“We have strong support from both Georgia’s Democrats and Republicans,” said Marta Stoepker, a spokeswoman for South Korean solar maker Qcells, which invested $2.5 billion this year in two Republican districts in Georgia. dollars, including Greene, a district represented by Republican firebrand Marjorie Taylor.

But a Republican-led House committee recently approved a bill to weaken the IRA, and the right-wing Heritage Foundation think tank’s “Project 2025” has drawn up a lengthy playbook calling for a potential future Republican administration to roll back the legislation.

“One of the biggest policy differences between Republican and Democratic candidates will be on energy,” said Diana Furchtgott-Roth, a former Trump administration official who is now a traditional banker. “The 2025 plan is about ensuring that the economy grows fast and grows faster with less spending, especially public spending.”

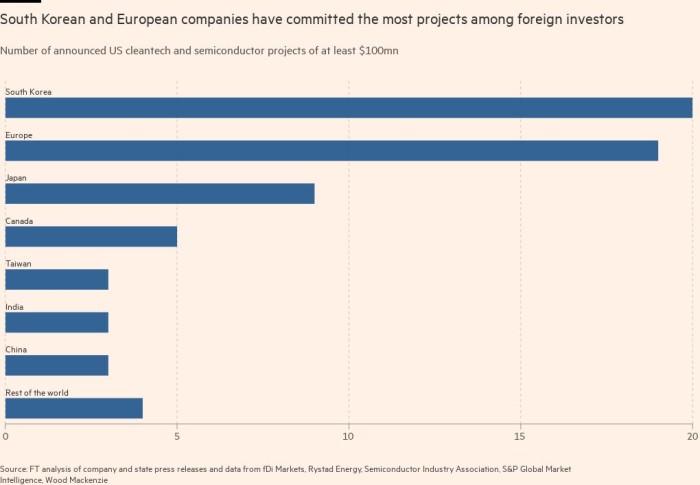

Korean and European firms lead in foreign investment race

Since last year’s big legislation, South Korean and European companies have led the influx of foreign capital, announcing 20 and 19 projects, respectively. The flurry of programs comes as U.S. allies roll out policies of their own to compete with IRA subsidies they say create an uneven playing field.

EU Economics Commissioner Paolo Gentiloni told the Financial Times last month that “the IRA pull factor is increasing” and called for a greater European response. In February, the EU announced a rival industrial plan that included subsidies for developers to stay in the bloc.

Swiss solar maker Meyer Burger announced last month that it was shelving its expansion plans in Germany to open a $400 million plant in Colorado to secure an Irish Republican Army (IRA) license. tax credit.

“I would be very happy if Europe recognized this new climate reality sooner and offered more support to companies here . from other companies,” said the company’s chief executive, Gunter Erfurt.

A handful of Chinese companies have invested despite deteriorating relations between Beijing and Washington, but many are too small to be included in the FT’s analysis. The largest of these include Guoxuan Optoelectronics’ $2.4 billion battery plant in Michigan and Fuyao Glass’ $300 million expansion of its auto glass plant in Ohio.

While the IRA’s EV tax credit allows developers to source some materials from overseas, materials imported from China are not eligible.

The Republican-led Congressional China Committee sent a letter to Ford last month announcing it was investigating a technology licensing agreement with Chinese battery giant CATL for a Michigan battery plant worth $3.5 billion that it announced in February.

Lack of skilled labor and raw material constraints are barriers

A July report by the Semiconductor Industry Association and Oxford Economics said more than 1 million computer scientist and engineer jobs in the U.S. are at risk of going unfilled by the end of the century. Construction lobby group Associated Builders and Contractors says the U.S. faces a shortfall of 500,000 construction workers this year alone as it tries to meet demand from new factory announcements.

“There are so many new factories being built,” said Gregg Lowe, chief executive of semiconductor maker Wolfspeed, which last year announced a $5 billion plant in North Carolina. “(The biggest challenge) is probably the labor to build the fab . . . then the second challenge is once you build the fab, you have to tool it, and the lead times for semiconductor tooling have definitely stretched out.”

Long construction periods, foreign technological advances and tight supply of raw materials will also hinder the development of supply chains.

A recent Bloomberg New Energy Finance report warned that new solar cell factories in the U.S. could become “functionally obsolete” within the next five years due to longer construction and new development lead times in Asia. S&P Global Commodity Insights said on Tuesday that the U.S. will struggle to rely on domestic resources and free trade partners to meet demand for key minerals such as nickel – a condition for receiving IRA tax credits.

That means East Asia could retain its grip on global cleantech and semiconductor supplies for a decade, analysts said.

The International Energy Agency predicts that by 2030, China will control more than 60% of the global wind, battery and solar supply chain. Benchmark Mineral Intelligence predicts that by the end of the decade, China will have more than double the battery manufacturing capacity of the United States and Europe combined.

Research firm Rystad Energy predicts that even if the United States becomes self-sufficient in battery and solar module production by 2025, it will still rely on imports for components such as battery anodes and cathodes and solar module polysilicon.

“The two largest economies will need each other to some degree,” said Andrés Gluski, chief executive of AES, one of the world’s largest utility developers. “A complete breakdown in trade doesn’t make sense – and it doesn’t help the global fight against climate change either.”

Are you aware of any new IRA or Chips Act programs in your area? Let us know: amanda.chu@ft.com

Svlook