Receive free Raine Group LLC updates

we will send you myFT Daily Digest Email summary of latest information Wren Group LLC There is news every morning.

Twenty-eight investment banks are participating in the $50 billion initial public offering of chip design company Arm. But one small consulting firm stands out.

The IPO filing features The Raine Group, a technology-focused boutique firm that went public as a financial adviser, giving it a higher status than Wall Street banks such as Goldman Sachs and JPMorgan Chase & Co., which underwrote the deal. The New York-based merchant bank was founded 14 years ago and has become a preferred adviser to Japanese technology investor SoftBank, which owns Arm.

The two groups are deeply intertwined. Last year, as SoftBank began preparing for an IPO, Raine co-founder Jeff Sine was appointed to Arm’s board of directors. SoftBank holds less than a tenth of Raine’s shares, according to people with direct knowledge of the situation.

The Japanese conglomerate is also backing Raine’s investment fund, according to Arm’s IPO prospectus, which highlighted the bank’s “extensive advisory services” to SoftBank in its related-party transaction disclosures.

Sain’s long-standing relationship with SoftBank founder Masayoshi Son, a prolific dealmaker, has been a lucrative one. Raine could receive up to about $10 million in the Arm IPO, which is expected to value the Cambridge-based chip design company at as much as $50 billion. The company has generated $2.5 million in revenue from Arm work in the fiscal year ended in March, according to IPO filings.

Charles Elson, a corporate governance expert at the University of Delaware, sees these concurrent relationships as potential conflicts of interest that could worry potential Arm investors.

“An outsider may not have all the information and how all the relationships impact the valuation,” Elson said.

A person close to Raine said he was used to managing potential conflicts.

“It’s unusual, but I don’t think there’s anything that strikes me as less than aboveboard,” said David Erickson, a former equity capital markets banker and lecturer at the University of Pennsylvania.

Wren remains in close contact with two serial dealmakers: Son and Ari Emanuel, a superagent and another early backer. The Hollywood power broker turned to Wren for advice on a series of deals that pieced together his agency, Endeavor, which has grown to span media and events. But when Emanuel purchased the Ultimate Fighting Championship for $4 billion in 2016, Wren represented the MMA franchise.

On Tuesday, Endeavor announced the completion of a deal to acquire World Wrestling Entertainment and bring it under the new publicly traded entity, which also includes the UFC. Raine advised WWE on the deal, collecting a $65 million fee in the process.

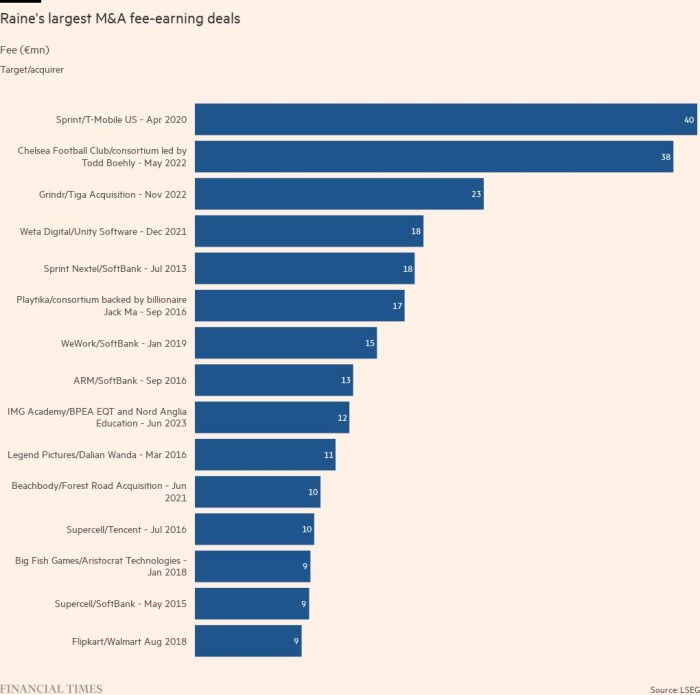

This week’s Arm IPO is the latest in a long-running partnership with SoftBank, which has brought Raine on board in deals including Sprint and WeWork.

Raine was a lead adviser to SoftBank on its $32 billion acquisition of Arm in 2016, a deal that delisted the company from the London stock market. When SoftBank agreed to sell the chip designer to Nvidia for $66 billion, Son partnered with the company again, but it ultimately failed. Wren is also helping strategic investors such as Apple and Nvidia back Arm as it returns to the public markets this week, according to people familiar with the matter.

For Sine, who has been passionate about producing shows on Broadway and in London’s West End, the Arm IPO allows him to reprise a similar role behind the scenes. He spent weeks coordinating dozens of bankers and developing strategy with Son as growing tensions between Beijing and Washington dampened investor enthusiasm for chip stocks.

The relationship is now in its fourth decade, with Sain and Son working together multiple times as SoftBank has grown into a major technology investor, tackling the dot-com bubble, the mass adoption of mobile phones and the rise of major tech companies including Alibaba The emergence of Alibaba has ties to SoftBank. Brought more business to Raine.

Son focuses on strategy, while Sinner helps execute his ideas, according to a person familiar with the matter. Raine managing director Chris Donini has been tasked with advising the massive Japanese conglomerate.

“We’ve been through a lot of wars with these people,” Seain told the Financial Times. “It’s a classic relationship where you try to put yourself in the client’s shoes and give them good, honest advice.”

SoftBank’s cooperation with Sine predates the founding of Raine. In the mid-1990s, while a banker at Morgan Stanley, Sine advised Son on his $2 billion acquisition of computer and technology magazine publisher Ziff Davis.

In 2009, during the financial crisis, Sine and Raine co-founder Joe Ravitch abandoned their respective employers, UBS and Goldman Sachs, to start their own businesses. They pieced together their last names to name the bank.

As bad loans and trading losses engulf the banking industry, Sain and Ravitch believe a traditional high-street bank’s advisory approach, close relationships with corporate tycoons and a strong focus on technology, media, sports and telecoms will set them apart.

As Sine and Ravitch built Raine’s reputation in the early years, Son became an important client. The 2010 deal involving Vodafone was the first in a long list of consulting jobs for SoftBank picked up on the Rennes website. In 2012, it participated in SoftBank’s $20.1 billion acquisition of telecommunications company Sprint Nextel.

Raine has since been involved in many other high-profile SoftBank deals, including the 2019 reorganization of WeWork, when Sine held a board seat at the office space group until resigning last year.

With Arm returning to public markets this week (albeit in the United States), SoftBank expects earnings of up to $5 billion to replenish Son’s coffers and create more dealmaking work for Raine.

Additional reporting by Sujeet Indap

Svlook